BLM Nominee Admits to Violating Congressional Ethics Laws and Likely Committed Mortgage Fraud

Tracy Stone Manning’s Questions for the Record were returned to the Senate Energy and Natural Resources Committee, and they show that she likely violated Congressional Ethic Laws and she likely committed mortgage fraud.

AAF had outlined in its previous report that the loan she took from Montana developer Stuart Goldberg was deeply problematic. Stone-Manning’s answers to the Senate Energy and Natural Resources vindicate AAF’s concerns.

Ethics Violation

In her questions for the record, Stone-Manning describes the loan arrangement she had with Mr. Goldberg:

In 2008, the economy put the stereo and home theater store managed by my husband in Missoula, MT, in difficult financial shape. Mr. Goldberg was a friend of many years; in fact my husband and I officiated his wedding. He lent $100,000 to the business in the short term in order for us to keep our home. In return, he purchased equipment for the new home he was building at wholesale, at a value of thousands of dollars.

Over a couple months, the economy worsened and crashed. The business failed. We ended up having to sell our home in March 2009 and downsize. We did not earn enough on the sale to pay him back fully. We closed the business, and rather than declare bankruptcy and walk away from the business loan, we took on the personal obligation to pay back the loan.

We paid him $40,000 at the time of the sale of the house and came to verbal agreement on the details of converting to a personal loan the remaining $60,000, which were: we would pay him annual interest, in monthly installments, until we could pay off the principal of the loan. We paid off the principal, in full, in 2020, after I received a modest inheritance from my mother.

Mrs. Stone-Manning worked for Senator Tester on his Senate staff from 2007 through 2012.

Mrs. Stone-Manning’s statement makes it very clear that she violated the Senate Gift Rules. The Senate Gift Rule, effective when she was in the Senate, states:

RULE XXXV

GIFTS

(a)(1) No Member, officer, or employee of the Senate shall knowingly accept a gift except as provided in this rule.

(b)(1) For the purpose of this rule, the term ‘‘gift’’ means any gratuity, favor, discount, entertainment, hospitality, loan, forbearance, or other item having monetary value. The term includes gifts of services, training, transportation, lodging, and meals, whether provided in kind, by purchase of a ticket, payment in advance, or reimbursement after the expense has been incurred.

…

(c) The restrictions in subparagraph (a) shall not apply to the following:

(19) Opportunities and benefits which are—

…

(E) in the form of loans from banks and other financial institutions on terms generally available to the public; (emphasis added)

The plain language of the rule makes the analysis simple. Mr. Goldberg was not a “bank or other financial institution” as defined by the Rules of the Senate.

Further, as someone who was, by her admission, on the verge of bankruptcy, her credit options were highly limited, and there is no way to conceive that an interest only unsecured $60,000 loan at 6% would have been “generally available to the public.”

Mortgage Fraud

Tracey Stone-Manning’s history related to her mortgage borrowing shows she has likely committed mortgage fraud by failing to provide banks with all the required information in federally insured loan applications.

In the Questions for the Record, she was asked specifically if she disclosed this loan to the banks she took a mortgage from.

From Senator Daines:

Question 36: Ms. Stone-Manning, during the term of your outstanding loan to Mr. Stuart Goldberg you have been the borrower on multiple mortgages. Did you disclose the outstanding debt to Mr. Goldberg as part of the loan application for the mortgages you have taken? If so, please provide the committee with a confidential redacted version of your mortgage application showing the disclosure of the outstanding debt to Mr. Goldberg.

Response: I do not recall the specifics of those loan applications and do not have copies of past mortgage documents. I fully honored the unsecured loan to Mr. Goldberg before I took out my current mortgage.

Since the time she was extended a personal loan by Mr. Goldberg in 2009, Mrs. Stone-Manning has taken three different mortgages before her current mortgage.

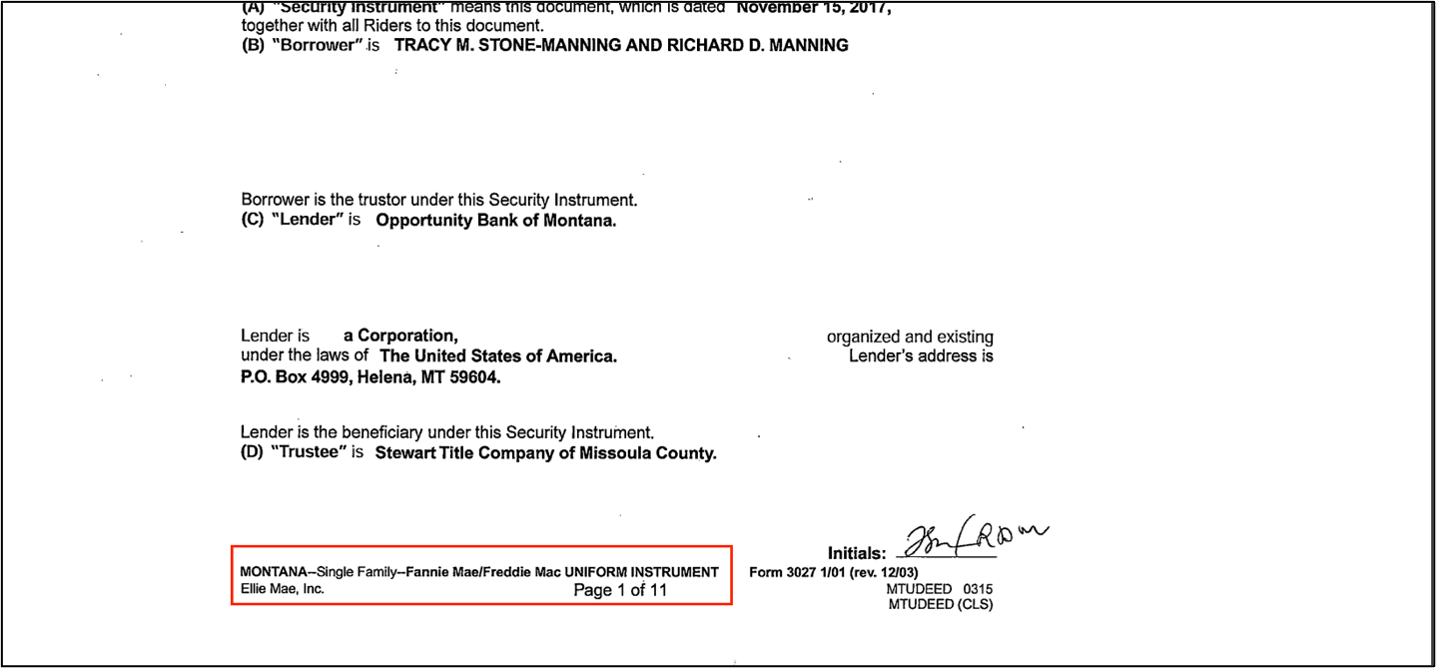

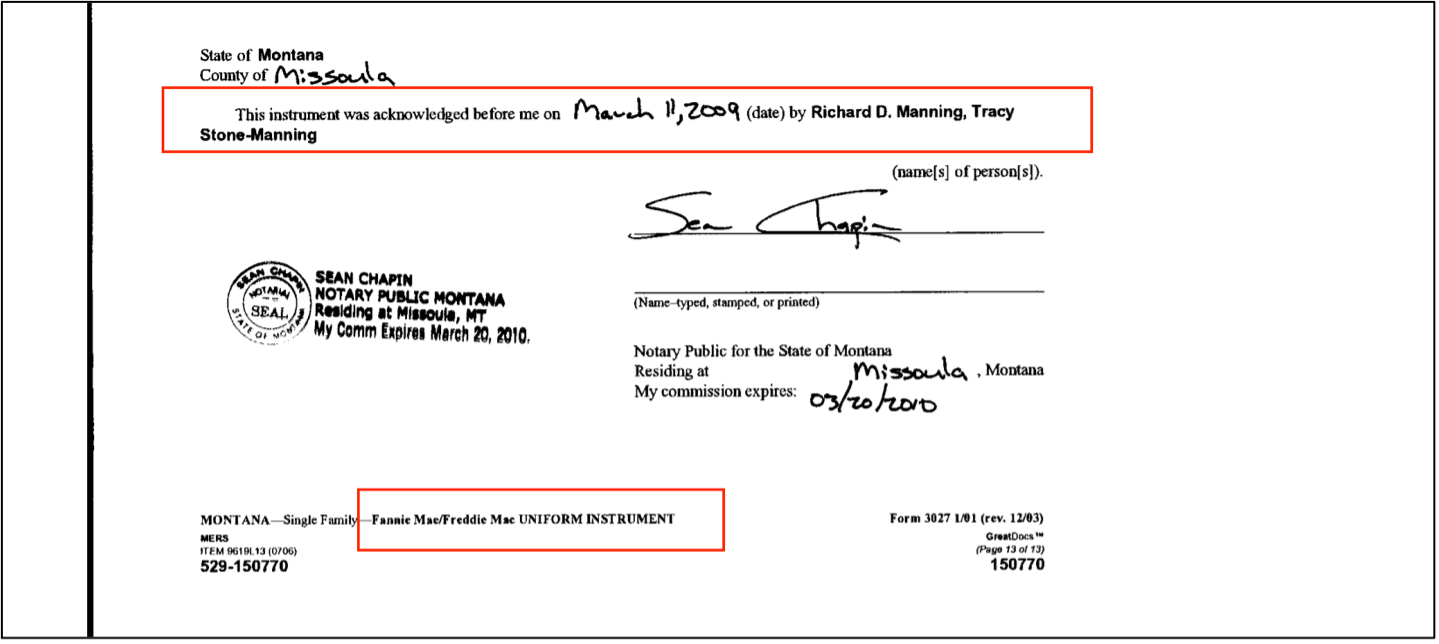

On March 11, 2009, Mrs. Stone Manning took out a $257,400 mortgage from Golf Savings Bank. As the paperwork shows, it was a federally guaranteed loan. *Note the box showing Fannie Mae/Freddie Mac Uniform Instrument

On April 28, 2010 she took out another mortgage with Wells Fargo for $297,800. *Note FHA (Federal Housing Authority) Montana Deed of Trust

November 15, 2017 Mrs. Stone-Manning took out another mortgage from Opportunity Bank of Montana. *Note: Fannie Mae/Freddie Mac Uniform Statement

As all of these deeds note, like most mortgages, these were federally guaranteed mortgages.

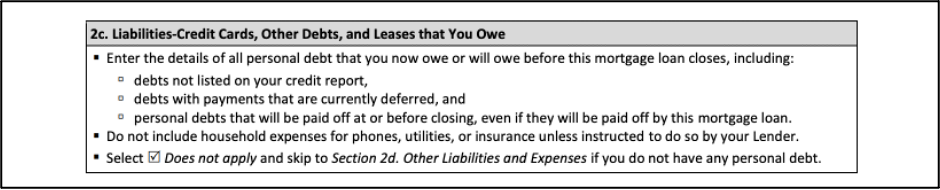

The federal loan application associated with a federal insured loan, makes it clear that you need to disclose personal loans. From the Form 1003 instructions:

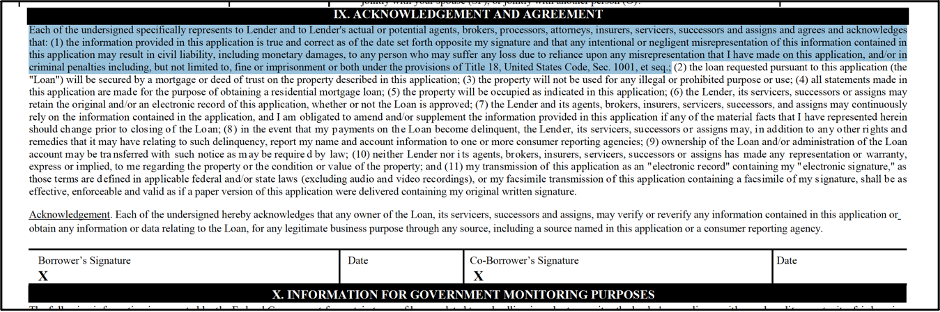

Further the application is very clear that, the borrower is stating that, “the information provided in this application is true and correct as of the date set forth opposite my signature” and that “any intentional or negligent misrepresentation of this information contained in this application may result in civil liability, including monetary damages, to any person who may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United States Code, Sec. 1001, et seq.;”

It seems likely that under penalty of perjury, that Tracy Stone-Manning lied on a federal loan application.

To ensure that a senior federal official has not violated federal law by lying on an application for a federally ensured loan, the Federal Bureau of Investigation should reopen Mrs. Stone-Manning’s background investigation and subpoena all applications at Golf Savings Bank, Wells Fargo, and Opportunity Bank submitted by Mrs. Stone Manning.